SCRABBLE® Cheat

My Stock Opinions

Current stock rotation is stocks with a lot of cash on hand and good earnings.

2-3-2023 - Article slams Jim CramerAs I was thinking how Cramer said 'It is not where a stock is it is where the stock is going' and most like Matterport (That he said Buy Buy Buy) went into the garbage. But the real problem is not spotting the pivot point which was the FED lying about inflation when inflation was spiraling out of control. You can say they were wrong but I say they were lying. Cramer was also denying inflation and sixe months later he is acting like he never said that. He always said call me I love to talk and when I call I get 'No comment' and he hangs the phone up. This latest article just finishes him off in my opinion and they only list some of the stuff as I could add to the list. I will let the article speak for itself.

Read article here

2-3-2023 - Veru and the FDA

The FDA adcom voted against Veru's drug Sabizabulin by 8 to 5. Even though they were only supposes to consider morbidity they talked about many other issues that the FDA said they were already good with. I can't help but think Pfizer is once again involved in killing a drug off because it could compete with their drug they make 5 billion on. If Sabizabulin passed Veru would probably start making a drug that competed with Pfizers. I have seen to much corruption and this smacks of it. I would have given Veru's Sabizabulin a restricted approval as it had no side effects and if the results were the same as the phase 3 trial then millions of people would be saved. Even more bothersome is the FDA hasn't issued a decision yet after the adcom and I have never seen that. I think the FDA wanted to approve Sabizabulin and was shocked the adcom voted against it. I am not because I know Pfizer has bribed people in the past as this article shows. . This is just my opinion but I stand by it.

2-3-2023 - Door Dash and Prescription drugs

I know a lot of poor people but I call them friends. They are very nice but I noticed they wait in the cold for a bus to the pharmacy. I can see a day when a law is passed allowed companies like Door Dash to deliver prescription drugs that they pick up for the person at the pharmacy. Elderly who have a hard time getting to the pharmacy would definitely use this service.

2-3-2023 - Oil companies huge profit a red flag

When oil companies make huge profits it almost always signals a recession. Oil is used in almost every product and not just gas. With refineries closing it won't matter how much oil is pumped as the refineries are maxed out and can't produce any more oil. More refineries are set to close this year. High priced oil leads to huge inflation which crushes the economy.

Now I saw the movie Deepwater Horizon and I am glad I sold my oil stocks. If I had to buy an oil stock I would find one that never had an accident like this. I can't invest in any company involved in Deepwater Horizon which are BP, Halliburton and Transocean. They killed 11 people so I will never own their stocks.

12-19-2022 - Did they lie to Jim Cramer?

Thinking for hours this morning. I've had a semi change on Jim Cramer. Complex it is. But Cramer was able to get the top analysts on his show. People with a track record so good it put them in the top 1% of analysts. So who wouldn't want to listen to them. Unfortunately they were all wrong except the phd from Wharton. I am sure they will all have the same excuse about inflation, covid, the war in Russia. These experts proved one thing. As Jim's favorite quote, 'They know nothing!' .

12-19-2022 - Don't forget when an economy gets hit with 20% or more loss it is considered 'Damaged'. This means it takes much more time to recover. So this ralley that ended over a week ago will probably be the last ralley for a while. At least after all the reading I've done. The analyst from KPMG who is still bearish and predicting a hard landing has been more accurate than all the others to. I wonder why no one listened to her. They don't believe her data? Because she is femaile? Who cares I say as I will listen to her. She predicts a hard landing. So I stay in cash.

12-16-2022 - This market is now to rough for me. Staying cash for now. Don't see anything worth investing in. Not even Walmart looks good to me.

It is time to let others figure out this market.

10-12-2022 I see women complain a lot about not being listened to, hired, promoted etc... Wow. For me I will listen to anyone. I remember Suze Orman had a show where she would talk about finances and had a funny part where she would tell you if you could afford the item you want to buy. Many times she would say no you can not afford it. So when my mom asked about annuities I remember Suze saying to a caller NO. And I googled and sure enough Suze says no to annuities.

Suze says no to annuities

10-12-2022 The one thing Jim Cramer got right was saying NO to bonds. As interest rates go up people are less willing to buy your bonds so the value goes down. If you hold the bond for the entire time then you will make what the bond says but there are better investments. In the 1970s when interest were high it was probably a good time to buy bonds. I am no professional at bonds and I prefer dividend stocks.

9-26-2022 Sitting in cash. Time to turn lights out as recession comes in. Watching Meta, aka Facebook tumbling as I calculate Jim Cramers average on his stock picks. You would be down 20% if you listened to Jim Cramer. 9/10 analysts on CNBC are down over 20% and some alot more. And the market is still headed down.

Jim Cramer was pumping Facebook when it was $330 and here is pumping as it falls.

9-26-2022 People shorting the stock market made a killing. Now most of the selling is done so a slow drift downward is expected. I am on the sidelines watching having gone all cash except bought some VERU, but only a small amount using RISK money.

9-1-2022 Nathans expression is exactly how I feel on the stock market. Nothing makes sense.

9-1-2022 NVDA is the best time ever now to buy it or it falls more. Energy have moved so much but they could move more if Russia cuts off gas. Liquid natural gas that goes to Europe is in mass demand but Cheniere Energy stock is up huge so that is risky to buy. You really have to know your stocks at this point in time. Rotations come fast and furios.

If I sell my oil stocks I will be mostly in cash.

8-31-2022 I do agree with Cramer on one stock, Costco.

Yes Costco looks good because everyone goes there. I see their parking lot full. I liked Amazon and many people like Walmart. Don't forget in this hard times people will want to save money and Costco is a great company that saves people money. Yes Cramer is probably right in saying buy Costco.

8-30-2022 Still waiting for the FED to start unloading 3 trillion. It must cause the stocks to go lower. Even oil stocks might fall. I can see a 10% and even 30% fall in the stock market. This last ralley was nice and I hope people got out. The best chartist alive just said Septermber will be good and then the market will tank. I think the ralley just happened and big funds will use this strength to sell into September

My risky stock Veru crahsed to $13.99 so I remember selling half my VERU at $24 and now I am buying it back at $13.99. Yes I am buying options again as if the drug fails the stock is basically dead anyways. So a rare time I buy options. And I am only, yes ONLY using my RISK money. Only use money you can afford to lose on VERU. I could have just walked away with a nice profit but I really think VERU will get approved now that FAUCI who only likes vaccines is retiring. VERU has a 4 leaf clover for sure.

8-23-2022 All I can do is wait for the FED to start unloading its 10 trillion in bonds. I don't see how this can be good for the economy. The day for finding the best stocks by searching is over. Now you need to study a stock for a week before you can decide if you can buy it. That just points to the economy going down imo.

8-23-2022 The stock market is falling as investors rush out the door. Freight will drop because of excess inventory. Target and Walmart and Amazon will have it tough because of the supply chain and the ships stuck at sea with winter goods. You can just keep adding more and more problems to the market. The bonds are inverted which is a horrible sign. Inversion means the 2 year bond now pays more than the 5 year and even the 10 year and this signals a recession every time this happens. 8-23-2022 Jim Cramer is probably the worst stock picker that became clear when last November when inflation hit and it became so important to sell almost every stock and go defensive. You have to tell people when you see Jim Cramer bragging he is lying. He had a buy on Coinbase at its all time high of $315 and it fell to $47. Jim Cramer gave 4 REITS and it did not make sense in rising interest rates and three of the four lost big money. Now I find another person tracking Jim Cramer and his conclusion is the same. Jim Cramer's horrible stock picks

John Oliver said thanks for the Jim Cramer story he ran with and roasted him on his show. All I said I wanted was a comment from Jim Cramer. But when John Oliver contacted Jim Cramer he had no comment. The guy with the biggest mouth in history saying how great he is has no comment. So please DO NOT listen to Jim Cramer. If he has an expert on the show Carolyn Boroden feel free to listen to what she says. But please don't even listen to Jim Cramer's stock picks.

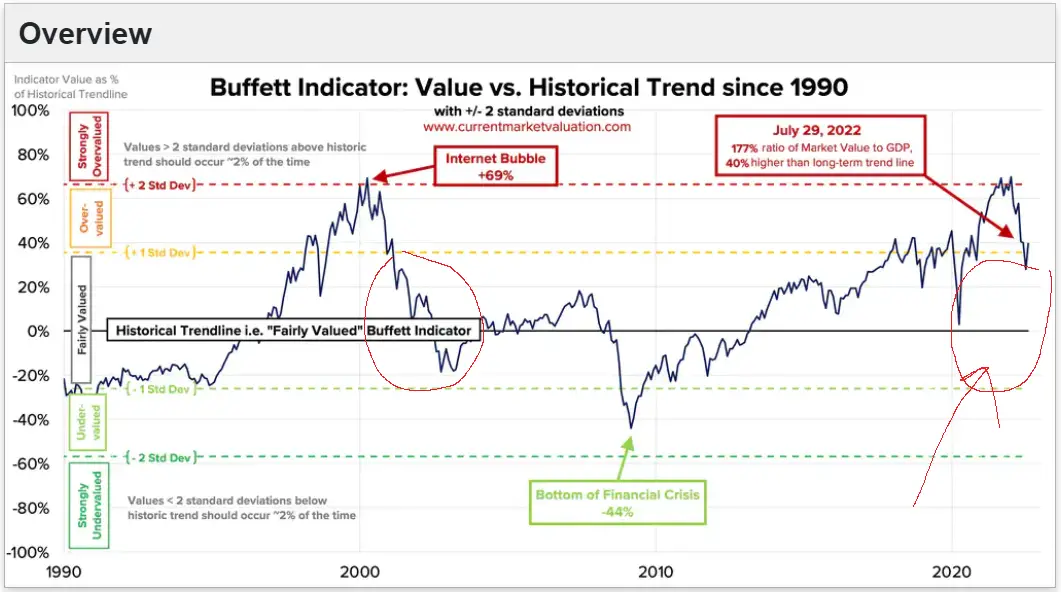

8-18-2022 These 2 are out of Bidens control. War in Ukraine which will also keep inflation high. The FED will start shrinking its 9 trillion debt. I don't even want to try to pick stocks in this market. The Buffett Indicator says the market is overvalued.

Aggregate US Market Value: $46.0T

Annualized GDP: $25.0T

Buffett Indicator: $46.0T ÷ $25.0T = 184%

I was in Devon at $50 and sold at $65. When these stable stocks soar that scares me.

I am expecting a poor stock market in September.

Kinder Morgan, Inc. (KMI) is very stable and a nice 6% dividend. But other energy stocks have risen to high which usually spells bad news for the economy. Look at DEVON , Kinder Morgan , Cheniere Energy, Inc. (LNG), EQT Corporation (EQT)

8-18-2022 Jim Cramer said sell Walmart so I bought Walmart and it has gone up 6%. I like Amazon and Target to but they have hit the top bar for now. Target has a great CEO and these companies are defensive. I sold them for now because September should be bad but I know Walmart did good during the last recession. But in the next months I wonder if everything will sell off.

8-8-2022 Jim Cramer got one right yesterday but I was laughing so hard I forgot what it was. He then actually said the market was over valued and to take profits. For once we agree.

Then I saw a Wall Street better put up this funny video.

8-18-2022 I have one stock left I own. It is my risk stock for money I can afford to lose and I put it in a stock I think will soar. Yes I can lose big on this and know it but so far it is looking good. I had all my RISK money in VERU at 12 and in options. Yes I know crazy. Sold much of it at 24 and now because a director sold some stock it fell back to 18. The same exact thing happened to Moderna and it soared later so I am not that worried. I've watched this stock like a hawk. The FDA has to visit sites in Brazil before any approval. But as one smart guy posted that is a good sign because the FDA won't waste resources so this means the FDA is gearing up for approval. I think he makes a great point. So look for approval sometime in September. But this is a very risky stock and anyone in this stock is saying they know this is a risky bet. But like my other post on VERU said the FDA is giving them a wink like they are going to be approved. The range of this stock is 12 to 24 and it is at 18. I want to rebuy after selling and I can either wait for it to fall more and risk it running or buy here at 18. My gut says it will run to 50 if approved and at 18 that would be a good return even though I think it might hit 16 or 15. This is just for Risk money. My main money is in oil/energy, healthcare. The problem is the amount of time you have to put into a stock to really know it is huge like 60 to 100 hours of research sometimes. And you have to watch it everyday. This is a weird stock where I know I can just buy at the price I like and it will either hit 50 or 2. Thus only RISK money you can afford to lose.

8-5-2022 - The Warren Buffet Indicator

Who can you listen to in the stock market. Warren Buffet is one. Warren is 1000x better than Jim Cramer and anyone on CNBC. So a great tool is the Warren Buffet indicator. It shows the market is over valued. So you have to be careful what stocks you buy. This would explain why there are so many people shorting the market. So this market is for pros. Defensive stocks are the ones to research. Coca cola has done good and General Mills and their cereals. This current pivot into tech stocks will be short lived as most professionals think the selling went to far and this is a rebound. But in September and later this year the FED will raise rates and inflation might still be to high and this is where I look at the Warren Buffet indicator. It is scary as you can see we can fall another 50% potentially.

Yes I to am using this rebound in the market to sell my stocks and sit in cash. I don't want to time the market and have the FED unload the 6 trillion US bonds on the market causing a sell off.

I listened to another pro who described what happens to 'damaged' stocks. Stocks that fall more than 20% become damaged and they can take years to recover. The bad news here just keeps piling up and their isn't enough good news to offset it. I still see a recession coming.

As you can see from the Buffed indicator chart.

7-27-2022 We are headed for a recession. This mini bull run will end and oil prices and inflation will lead us into a recession. Is this already priced into the stock market. Does it even matter since I can't see stocks moving higher by much. Dividend stocks in companies with good earnings and low PE and lots of cash to withstand a recession are the stocks I want. Coca Cola and oil stocks like Chevron come to mind.

Reasons for a recession.

1) Oil prices are sky high

2) Russian war.

3) Inflation will last for many months

4) Harder to get a job and salaries will fall.

5) Most of all the Housing crash will hurt many people. Yes housing prices are falling.

7-27-2022 Jim Cramer isn't worth listening to

The experts Jim Cramer has on his show were also wrong. But Jim Cramer keeps lying about his stock picks. He gives horrible advice and I have said since I started tracking him he was wrong last November. Now I found this video proving my words are true. I do like his comment 'A lot of smart people and Jim Cramer.'

All of CNBC is a circus that you avoid. Bloomberg is better to watch. Stock websites that show the current bond rates, yields and news are 1000x better.

7-26-2022 **If you have RISK money** then Veru in the buy zone at $12.75. Veru makes a pill to help Covid patients who are very sick. It is not a vaccine! It was a cancer drug that they happened by chance to find out works against Covid.

I put my risk money into Veru as $12 to $13 is a good risk to reward according to Jeffries.

As Veru is days or a few weeks from hearing from the FDA and nothing has changes. Jeffries still has a $55 price target on Veru. Veru's drug It is a pill not a vaccine.

Jeffries Analyst Predicts FDA Emergency Use Nod For Veru's New COVID-19 Therapy In August.

Sabizabulin was well tolerated with a more favorable safety profile compared to placebo.

Sabizabulin published in the New England Journal of Medicine "addressed most concerns," Jefferies writes.

The analyst sees the data as "further derisking" Veru's COVID opportunity and reiterates a Buy rating on the shares with a $55 price target.

The data likely signals an FDA Emergency Use Authorization in 30 days, Howerton contends.

7-26-2022 I watched Jim Cramer. He said buy Walmart so I shorted it. He said sell 3m so I bought it. Then CNBC had analyts pumping Snap all day with a price target of $26 so I shorted that. So Walmart went down and I made money. Snap went down 40% and I made great money. And 3m went up 10% and I made money. I am thinking of starting a fund called Jimbo where we do the opposite of a what Jim Cramer recommends.

7-15-2022 Veru with stock symbol Veru and price of $15.50 might have a block buster pill on their hands. By sheer luck their cancer drug hits the exact thing lung area that Covid hits and upon trying it out they found it works.

Veru makes sabizabulin which has proven to lower risk of death from Covid by from 45% to 20%. They filed for Emergency Use Authorization and the FDA has already looked at the data and offered advice and said they can file for the EUA. So its been 34 days since Veru filed and anytime in the next three weeks the FDA may approve Veru's sabizabulin drug.

Yes I figured at $12 the stock will either go to the moon or $0. Jeffries has an analyst following Veru and upped his target to $58 and says it could hit $98. So I bought $2000 worth of options set to expire in 2023 so if any delay hits I am safe. If the drug gets approval I win big and if it gets denied than I just lose $2000. The stock will go to $4 if the drug is rejected so why not go with options in this case. This is the one case options work but only use money you can afford to lose. The FDA can issue their notice in the next 30 days so I just got in now in case the FDA decision comes tomorrow. I bought another $1000 in option at $15 after doing more research. They have been published in the New England Journal of Medicine. Amazing they develop a cancer drug that when they just happened to try it on Covid it worked. People who were about to die from Covid took Veru's sabizabulin and many lived. The committee of experts stopped the phase 3 trial early because of the success. When you see the pressure the FDA is under to find a therapeutic and not just more vaccines you can understand why the FDA's eyes lit up when they say Veru. There are many people who will not take the vaccine and this pill is the one life saver they can take if they get Covid. Let's hope the FDA determines the data really is solid and good and approves Veru's drug.

Veru trial stopped due to success

7-14-2022 ONLY HEALTH stock are worth looking at imo. Cyber security has done ok but being tech stocks scares me. Like Crowd Strike and Palo Alto and Fortinet. Companies need cyber security but can they make a profit in this market?

Even healthcare just like oil stocks has been over loaded with money. UnitedHealth Group Inc is now pretty bought up. I personally sit in cash now.

It is a game of wait for the next rotation.

The economy is bad. Oil prices are sky high. The Russian war. The supply chain problems. Inflation is sky high. So I am in cash right now.

When the FED says rate hikes are over that may be a signal that inflation is under control and the supply chain is back to normal. Then the stock market will ralley but how much? That is what I am waiting for. Until then I expect more down days and selling.

I know Jim Cramer's picks were horrible. Coinbase??? Matterport??? Paypal??? Snowflake??? and many more that were disasters. But the reason I don't like him is because he is a liar. And not just stocks but even cryptos. He said he told people to get out of Ethereum and then I find this.

Jim Cramer the liar

It is useless to post it on youtube as CNBC has an army running around getting all videos deleted from youtube.

I only watch CNBC for the experts they have on that actually contribute great advice. I just put the dvr on pause and when it kicks on in an hour I can shoot through to see if there are any experts on. But CNBC is full of hot air other wise.

------------below are all older posts-----------------

My SAFE stock list. My dividend / Value stock list updated daily. These stocks I own I will post here. I call these my SAFE stocks. I read Barrons, other news channels, and of course Jim Cramer. But in the end I have my own research. This is my money I want in the stock market with little risk of it going down.

****I update this list often

Bought on 10-27-2021 Bristol-Myers Squibb Company (BMY) $56.49 for good earnings and good future and 3.39% dividend.

Chevron I already own and will hold until oil prices drop into fifties. Great Dividend.

Simon Property Group, Inc. (SPG) I already owned and 4% dividend its still good.

Coca-Cola Consolidated, Inc. (COKE) I already owned and will keep owning. Great safe stock.

Prudential Financial, Inc. (PRU) I own and is run good and many people I know have Prudential products/services.

Hasbro, Inc. (HAS) I have owned and has good dividend and great value

Just bought Intel (INTC) . Institutions are buying it. Great stock to own in inflation period. New cpu is great. Intel is on the comeback trail.

Kinder Morgan, Inc. (KMI) Honeywell International Inc. (HON) I am a buyer again here. Good products and management.

Invesco S&P Global Water ETF (CGW) Added more because of infrastructure bill passing

Global X U.S. Infrastructure Development ETF (PAVE)Added more because of infrastructure bill passing

Bank of America Corporation (BAC) I owned at $40 and an buying more.

American Electric Power Company, Inc. (AEP) good strong dividend stock

UnitedHealth Group Incorporated (UNH) good strong stock for Covid environment and good dividend

12-6-2021 Added Ameren Corporation (AEE) $85.90. Good inflation stock.

12-8-2021 Ford (F) $19.91 as they are going electric and the Ford 150 electric will be the biggest winner.

12-9-2021 I forgot to post weeks ago here that I bought more Apple. But I posted down below.

12-23-2021 Eli Lilly and Company (LLY) $271 - two blockbuster drugs next year and 7 potential drugs in addition. 12-8-2021 Sold have my Ford (F) and put it into Volkswagen AG (VWAGY) $29.15 to own both car makers.

End of my SAFE stock list

5-25-2022 Target, Amazon, Walmart over bought and have excess inventory. Every company has massively misplayed this supply chain crisis. Biden messed up just as big as Trump if you look at the big picture. Then the FED misplayed because they read Trump and Biden wrong. Companies had their legs cut out from under them. Only oil is doing good. From the strongest economy ever to the worst. 5 trillion dollars wiped out already. I look at Biden and I don't know if he gets it. You won't have any good news until July according to the experts. I know plenty of people who are starting to accumlate some stocks and will buy more in the coming months. I hope the market doesn't keep going down on them. I know they bought NVDA at 192 and its now 161. Every stock Jim Cramer picked is down at least 10% this week. I track him to see much worse he can get. His show is a three ring circus which does have the occasional expert on that is worth listening to.

5-21-2022 CNBC needs to go off the air. It has become a circus. The latest victim is Deere stock they propped up. Cramer loved Deere so I of course watch it to see if its another victim of his horrible calls and yes it is. Bloomberg is more of a stock news channel. The entertainment of watching Cramer ends when he starts costing people half their money and he won't stop. I wonder how many people watched his blurb on Deere and bought in big to lose big. Now he is doing the same with CAT. Oil stocks are the only winners and they can only go so high. Well cyber security like Palo Alto, Fortinet, and Crowdstrike but they can only go so high

5-20-2022 CNBC has hit a new low. Jim Cramer's last 5 stock picks have been horrible. Instead of saying go cash or just own oil or even bet against the stock market he chooses Walmart. I could list all his horrible picks but he pumped Walmart so much it takes the cake. Walmart is down 25. His horrible Paypal, Matterport and on and on. He is entertaining but very dangerous. He has some very good guests on his show but I don't even listen to his stock picks anymore. Plus we are headed for a recession so the market will keep going down especially with oil at $110 a barrel! Chevron, Devon, Pioneer Natural Resources, Diamond and almost any oil stock pays good dividends. Once oil prices fall I just sell the stocks but there is no sign of oil prices going lower into the peak oil season of summer travel. Inflation hell is here. This market is bad. Cash is king.

3-30-2022 Until oil gets under control inflation will roar. I listen to CNBC analysts and do the opposite. Now you can see inflation will outpace consumers. Cramer said get out of Bitcoin yet Bitcoin has held up better than any stock. I look back at my notes when he said buy Paysafe which is down 80% sitting at $3. Yet he keeps running his mouth. CNBC is useless having analysts spell the doom for Apple as it went into the 140's and then turned around and hit $179. You hear on CNBC as they say wait until everyone gives up and then you buy. When that happened weeks ago they all were saying sell. Sure enough that marked the bottom.

The problem now is the economy is staying super weak. It won't take much more to push the stocks back down. All I want to say is oil is still safe but I can see oil going down and the market staying weak. The last weeks were great and I can see people just selling again and sitting. I can't see an end to the supply chain crisis.

Even worse you have to watch the market every day because things are changing that fast. I've never seen a stock market like this. I actually prefer Alibaba(BABA) right now over the usa stocks. Biden, the FED, everyone will blame each other. Bitcoin won't be safe in a downturn either.

3-25-2022 I remember this headline 'Cramer’s lightning round: Buy and hold Alibaba' and now Cramer says its your fault for buying stocks in a communist country. Such a hypocrit and dumbass. Now actually isn't a bad time to use risk money in Alibaba (BABA) because China says it will leave the stock market alone. Every time it hits $110 people buy it knowing it will hit $130 next and then anywhere up to $200. CNBC is just horrible station now and Cramer a total liar.

3-25-2022 Biden needed to keep oil under $100 a barrel. Everyone poured money into the oil stocks so they aren't that good of a buy right now. But it is hard to find better stocks. This is why you are seeing UpStart go up $10 and down $10. The new term is called oil trap. This happened before the Russian war.

3-25-2022 Cleveland Cliffs stock even hit $132 and I sold all of my shares in it today as I've seen this stock nose dive but he can easily go higher. I just don't know how to play it since it has hit my price target of $132.

3-16-2022 Today Jim Cramer goes off calling everyone stupid. He called people to sell their china stocks yesterday when these same China stocks moved higher than any stock market in the history of the world. Talk about the one you should say you can buy these stocks and Cramer says your stupid and sell. Then I see the first caller asks about Qualcomm and Cramer has been saying buy buy buy as this stock goes down down down and he tells the caller everything is fine because in five years you will be happy. Wait isn't this how he went off of Cathy Woods who said the exact same thing. The last 20 stocks Cramer has said buy and the three is gave his super buy to are down 50%. Only oil stocks are up. Do no listen to this guy. I am stopping tracking him now since he has gone so bad.

Only listen to the experts he brings on the show and never to Cramer himself.

3-15-2022 Oil is falling. When the Russian war ends with Ukraine the stocks will pop and then you can sell for a quick profit. But with oil falling it was time to sell oil stocks 2 days ago. Maybe banks and health care are where the money will rotate. But after Trump and Biden and a horrible FED policy and the Russian war the stock market is basically dead.

My bet is Apple, Microsoft, Google, Amazon will make comebacks. Google and Amazon are splitting their stocks so they should do fine. Apple can't be stopped unless the government files anti trust as they are just that good.

3-9-2022 I think oil for $150 barrel is almost built in. I am selling more Chevron to take profits. I will keep some but I need to take some profits and not get to greedy.

3-8-2022 Oil should pause soon as more small players start to pump as much oil as they can. But there is smuch a huge demand can these small players fill the gap. I bet they can come close because of the amount of money involved.

3-8-2022 CNBC is the worst news channel. They are wrong about everything. I just walked in the door and flipping through saw them bad mouthing the market and saying today would be horrible. Literally as they are saying this, all 6 of them, the market starts to head up. It went from 100 points in the red to over 300 in the black. A 400 point swing. CNBC has the biggest idiots in the world on tv. You can not listen to a single one of them. They are absolutely the worst I have seen. How can these people show their faces on tv after all the bad calls they made. Not just these six women today but the guys to and especially Cramer.

3-7-2022 Horrible leadership from Trump, Biden, the FED and Congress has $150 oil. This can only lead to recession.....

3-3-2022 I told people to sell any stock Cramer recommended. Snowflake is the latest victim dropping 20%. Avoid Cramer at all costs. In fact I went back and examined analysts that did good in the first half of 2021 and also Barrons. All of them have done horrible from June 2021 until now. I will probably end up with all my money in oil stocks like Chevron. Oil has to top sometime but I swear it seems like it will hit 150 a barrel, omg

3-1-2022 CNBC needs to shut down. Cramers last 5 picks were horrible. The 4 analysts they have on the show are horrible and half are still pumping Facebook. It is a pathetic network that knows nothing about stocks. The more I watch the more I cringe now. Cramer had a pick yesterday, GoodRx Holdings, Inc. (GDRX) and he said buy it and I sighed and hoped people did not listen to him. Today Good RX is down 40%. Can he pick any worse stocks? Is it possible? As he likes to say, He knows nothing.

3-1-2022 Sibanye gold miners to strike over pay until wage demands met. So with Russia problems and these guys striking. I just sold my Sibanye Stillwater Limited (SBSW) after 12% gain. It is unreal as where will the palladium come from now? I hope they solve the strike so I can maybe buy it again. How can they not afford to pay the miners more with metals at all time high?

2-28-2022 Might sell some of my oil which I own to much of now and buy Enphase and Generac with the small percentage I sell. Oil is still doing great.

2-24-2022 Big institutions are buying growth stocks as well. The recovery is underway as most inflation is now priced into the stock market.

I bought NVDA, APPLE, Upstart, and there are many strong stocks out there. Make sure you buy ones with earnings and and strong guidance like Apple. Google and Amazon should do good to.

2-21-2022 if Ukraine war breaks out rare earth like Sibanye Stillwater Limited (SBSW) and agri funds CORN and WEAT will do good. Sad but true.

2-21-2022 With war looming in Ukraine its sell tech stocks and buy Chevron. Same old story. Many elements to make chips come from Russia/Ukraine. The ETFs called WEAT and CORN should do good as food prices will spike. Market just keeps getting worse and worse.

2-16-2022 Outside of oil I see nothing but flatness. I did tune into cnbc junk shows this morning to see the usual amount of lying. Stocks they pushed months ago they are saying they warned about. Even their retail expert who said retail was stronger than he had ever seen last year now was in denial. Cramer is doomed after his moronic Paypal call and facebook call. Biden and Congress have to find a way to end the supply chain problems or this year will be bad.

All research has to start over from scratch on all stocks. Oil would be the only exception as it is clear their will be a lack of supply in oil and the dividends in oil stocks are safe.

2-14-2022 The supply chain further hurt by the trucker strike.

Key metric now is the 2 year bond and 2 year bond. As the 2 year bond approaches the 10 year price the FED must take action. If the 10 year rises then the government pays a lot more for its debt. So all these supply chain issues, trucker strikes, Ukraine was threats, etc etc are causing bonds to rise. Biden not getting oil under control. You got oil dividend stocks or cash to choose from. Even Bitcoin went up as people fled to it from other weaker countries with huge inflation. I called Trump a failure for not paying down the debt, closing tax loopholes that he promised to and now Biden is a failure for letting oil get to $100. The biggest economy we ever had has been ruined........

2-11-2022 Only oil is holding up. This market will be flat all year. Hard to believe a super strong economy has come to a grinding halt and crash in just months.

Now Cnbc does it again. I gave up even watching this channel at all. Now some friends are saying it was Cnbc that reported Affirm had another big earnings after the company made a huge blunder and tweeted this before the markets closed. Cnbc doesn't bother to call the company about this tweet to see if its official and let them know about this illegal tweet since the market hasn't closed. Cnbc reported on this so called breaking news and Affirm's stock rose from $60 to $88 in minutes. People were pouring money into this obviously from Cnbc's news alert. Then Affirm takes down the tweet and puts up its earnings early because of this leak. The earnings showed a miss and not a big increase like Cnbc reported. Now the stock sits at $52 and all the millions people poured in up to the $88 mark is all gone. So these people thinking they had the scoop of a lifetime are now down 30% to 50%. And I see Cnbc going on as normal now and no mention of this.

I have monitored Jim Cramers pick for the last 3 months and he picked 3 right and 11 very wrong. Cnbc analysts favorite growth stocks were Paypal and Facebook which are the 2 worst stocks to own with each down over 30%. And now Cnbc failing to verify a source before going live on their channel is just unprofessional and that station is now a three ring circus of clowns.

I went to the stock forums and see many people lost $100,000 or more. Yet Cnbc won't even talk about Affirm or their actions. The lawyers will probably sue Affirm and Cnbc over this.

I still just sit in oil stocks until the FED is done ruining the economy.

2-3-2022 Cramer is turning out to be the worst stock picker of the year. Proof you can and do pick better stocks than the pros. Good old Jim Cramer saying "Buy FB right before 4 PM the day of the earnings" and while a friend told me he said this I believe him. To be fair all of CNBC was pumping Facebook as a great awesome company you should invest in. It was probably the most pumped stock on that channel. It had a low price to book and they went on and on. To bad they weren't pumping Google. Remember pick solid earnings stocks that have strong cash balances on hand. The big leadership stocks. Healthcare should do good this year so companies like MetLife and even Prudential should do good. Real estate should hold up. Use Google and search for 'best inflation stocks' and 'what stocks do good during inflation' and start there. Warren Buffet has his favorite inflation stocks like Coca Cola.

2-2-2022 Lady being interviewed today had a nice idea. All those boats stuck off the ports hold tons of stuff. That stuff will arrive way late and could end up faster at discount stores like Ross, TJ Maxx and Burlington. These type of stores could end up the winners if she is right.

2-2-2022 Big money is stilling sitting out. It will be important to see how today ends. Only 33% chance this ralley continues.

2-3-2022 Google looks great. If this horrible stock market makes Google stock fall I will buy some. The stock split always makes more people buy. But the big one could be that this stock split might allow Google to join Dow Industrials. That will raise the stock price as well.

2-3-2022 If you watch Cramer or CNBC or any stock analyst on tv then spend a week doing proper research yourself. If you see the stock reporting earnings or news hits you should know how to cram your research into 1 day and its alot of work at that speed but I've done it.

Don't waste your time on Paypal. Don't buy it period. This fall was because it missed earnings and as a growth stock that is terrible.

Still 50-50 on the stock market retesting lows. It is a big plus in the market going green for 3 days now. But another selloff could happen just not as probable as it was. Maybe the big money will come back in if they see its safe.

I have no idea why Cramer wasn't saying buy Google and not Paypal.

2-1-2022 We did finish in the green for the 3rd day in a row forming a slight candle. The bottom may be in or another dip which would be the bottom. Anyway we are close to the bottom. People who bought should just hold and save money to buy more after any other dip. I wouldn't be buying anymore right now until the Fed raises rates in March. All the buying came at the end of the day here which is a great sign. I quickly jumped on NVDA, TSM, ASML and did buy some AMD who had great earnings. Most people are working and can't watch the market. Bottom fishing on strong companies that have lost 40% in price. I hope others were able to spot the end of day ralley and jump on board. I will be looking for other good stocks if the economy improves

2-1-2022 To slam Jim Cramer and his balony worthless chatter as well as his lies over the last month. Just yesterday on his investing club he says ''We like PayPal as much for payments as its wider fintech roadmap''.

Now Paypal is down 17% on horrible earnings. Now will Cramer say he warned people on stocks like Paypal.

2-1-2022 Careful. Oil stocks are starting to weaken. But I find it hard to see only dropping below $70 so dividends should be ok in oil.

2-1-2022 Can Intel get these EUV machines in time to catch AMD? Doing more research I see Intel doesn’t expect to ship EUV chips until 2023. I look more at Apple as winning and the ONLY maker of EUV machines ASML Holding N.V. (ASML) as having a lock on the market. Might be a good buy there! And Taiwan Semiconductor Manufacturing Company Limited (TSM) has these EUV machines from ASML and this is why I like TSM. They will make 2 nm and 3nm chips when Intel can't. Intel can catch up and their CEO is great but they can't have any mistakes. If Intel does catch up they will make a lot of money.

2-1-2022 3rd day of the bottom and the stock market must end in green or more weakness will come. I think more weakness will come and we will retest a bottom. The inflation and supply chain will make people take profits they made in the last 2 days. Today already looks choppy and makes me write off this rebound. To many companies started putting out only the good data like Sentinelone where looking at it now you see Crowdstrike crushes earnings and Sentinelone is far behind. Crowdstrike and Fortinet and Palo Alto are the leaders and if Sentinelone can't get its earning up it will fall behind. Sentinelone misled on how well they were doing and they didn't get many new customers so I write them off for misleading.

Buy only top earnings companies with big money to buy smaller companies and gain.

1-31-2022 Cyclical stocks will do well up until the first rate hike if history repeats. Experts picks are Disney which should do good but because of Covid who knows. Nucor should do ok making steel for companies. Caterpiller should do good but China is weak. Expdia should do good but Covid holds it down. So why would I want to buy these over Coca Cola which is defensive and pays a dividend? Yes I will buy Coca Cola and watch these cyclicals.

I want Disney but not while Covid is raging. Will these experts be right and big money goes into these stocks? It is amazing how risky the stock market is when you can't recommend Disney but I have no problem with anyone buying it at this price either because Disney is a super strong company.

1-31-2022 Yes Cramer says he only had 4 losers. He is a liar. I bring you today Lam Research Corporation (LRCX) he said buy at $730 and is now at $580. Lam Research fell hard after horrible earnings. Cramer by my count has more losers than winners. If he can't tell the truth I am done even watching his show.

. 1-28-2022 When Chevron hits $135 feel free to sell and take the profits. Everyone is jumping into oil that I feel its saturated even though oil price is going up up up. Then you have to find a better dividend stock.

Already sold my Lucid put as it fell the very next day. I rarely use puts and made 30% but should have had a shorter date to cut costs even more seeing it was short term play on this horrible market.

I watched Cnbc and all the hosts trounce Apple because the stock market is bad and they are doing their job. Pointing out all the bad head winds Apple faces and helping keep Apple stock at $161 until big funds moved in and soared it to $170. Apple was/is the best tech stock and in the 150's I hope everyone bought it.

Cramer still pumping AMD. The problem is AMD is limited by TSM in how many chips it can make. This is why Intel always catches back up to them. This new Intel CEO will find a way. So the winner looks to be Apple who has no competition like this. Intel is getting into Gpu's as well so all gpu makers might see prices slashed and profits.

1-28-2022 Margin wash outs have happened but the usual candle formation I see broke down thanks to the FED's hawkish statements. So we need to see many consecutive days of the market closing in the green. At least for me.

1-28-2022 Buffer is 70 basis points according to analyst on Cnbc. So the bottom could be near if this means the FED now has the fear of God into the markets. Gives the Fed some room to move. First real sign to and end of the selling. That is just one signal. Apple had a super blowout quarter and good guidance the market didn't even care. Not a good sign there. Stick to big stocks with good earnings and dividends.

Cramer is still pounding the table on AMD and NVDA which are both down 30%. He is choosing to go all in and refusing to admit he was wrong.

Also Taiwan Semiconductor Manufacturing Company Limited (TSM) is down to $116 and that is not good as they make the chips for AMD and NVDA.

1-25-2022 I am buying a bit ahead of the FED meeting after just getting in touch with the smartest man I know. He thinks the FED put the fear of God into the Big Tech Giants and the FED meeting will be a relief to these stocks. Nvidia, Microsoft, Amazon, and maybe Google and Snowflake. This is because this is the industry I know best. I have no idea about other industries right now. I am still 78% in value dividend stocks. I won't touch Union Pacific Railroad as I keep reading they are getting their train cars robbed while they sit in the station.

1-25-2022 Kimberly-Clark just said inflation is real. Dividend value stocks will remain the best way to preserve my money in inflation. Sitting money in the bank is the same as losing money. With inflation at 7% you need to make 7% on your money just to preserve your current net worth.

With this huge market selloff you might pick up the best of the best. Moderately risky here but not as super risky as weeks ago. Everything depends on what the FED says today. That is why I am waiting for the FED to announce their economy rate plans at 1:30 pm today.

I am calling for Jim Cramer to come clean and stop lying. He needs to explain his Matterport all in call when it was at $30 and now is at $10. I refused to buy Matterport after my research and he won't even talk about it when you call him on the phone directly. He also has to explain he buy calls on AMD and Nvidia when I bought Intel. Both AMD and Nvidia fell over 20% easy since he said buy. Now he said he had 13 winners and 4 losers and this is a lie. He had many more losers and they lost 20% to 70% of their value and his winners only went up 10%.

If the market does bottome the strongest growth stocks will move first. Microsoft, Snowflake maybe, Amazon, Apple. Buy companies with low P/E and yes that means they have to have earnings and be profitable with no debt. This is why I like Intel. The new CEO is great and I like the idea Intel can gear up and fit its own factories to its own specifications for its own chips. Intel is very profitable with no debt and its new cpu's and gpu's are looking very promising. Intel is on the comeback.

1-25-2022 I just noticed a super flat stock, Lucid Group, Inc. (LCID). I bet hedge funds notice this to and short it. The stock is so flat it forms a bad pattern that often leads to a sell off. I actually will put my risky stock in a put on Lucid. NOT a short where your losses are unlimited but a put. Most people don't know how to buy puts and this is where i missed the boat on this last selloff. But Lucid just doesn't look strong at all. I got a put at strike price of $30 on it by June. I never do this but I have seen this chart before and Lucid is facing alot of pressure so a selloff is likely considering the economy is bad. Remember it has no earnings so don't expect institutions to but this stock. There are some good points to Lucid but without earnings I see it stalling out.

This is a very sad indicator of Trump and Biden and the FED when people start making Puts and betting against companies. But I go where I can make the money.

1-14-2022 Humans are better than AI. AI just missed SentinalOne doesn't have the money to compete with Crowd Strike or Palo Alto. Disney can't turn ESPN into a gambling site as it will ruin their image. So you think hard and you find out these stocks have problems. Disney needs to sell ESPN to a gambling company.

Cramer on AMD. Intel is going to come back and AMD will lose share in all reason. TSM which is Taiwan Semi makes the chips for all of them and they will be the winner. Back to the basics and my own thoughts as listening to the experts has proven bad.

1-10-2022 Why don't we just say oil oil oil stocks are the way to go until oil prices drop. Banks like Signature Bank and Bank of America and Morgan Stanley are good. I have a list I am looking over but I won't buy any in this market. I noticed some like Latch are way down but will they ever come back? People keep talking up Matterport but is this the economy where they can make any money? I keep watching Rodu go down as Cnbc experts scream Roku is a buy. We have supply chain problems, covid, inflation, and the FED getting ready to tighten. Be very careful of what you buy. Biden is going to go down as one of the worst presidents since Carter and the reason is because of what Trump did as president. He didn't close the loopholes and had a huge tax cut for businesses that we can't pay for. The FED buying 9 trillion in debt didn't help either. So Biden has made very unwise decisions because of the old 'well the other side spent 5 trillion so I will to'. Very bad for our future. The best economy we ever had is griding to a halt from all these morons. I am stunned. One guy I listened to said he was in cash and that is not a bad idea. Chevron gets you a nice dividend though.

1-10-2022 Intel first mover ready to launch L4 Electric cars in 2024. Very impressive. Intel also making leaps in cpu's to catch AMD. Intel also releasing a full featured GPU to compete with Nvidia.

https://www.fierceelectronics.com/electronics/mobileye-zeekr-build-l4-vehicle-2024-release

1-10-2022 Zynga is up 40$ on a buyout from Take Two. But they are guaranteed $8.50 and the stock is right around there. The buyout offer was for $9.86 in cash and stock. Worth looking into. There seems to be no downside if you will get your money back at the worst. And if the price goes up before the buyout you will make money. But they could pull out of the buyout which is unlikely. This is a decent risk to make 10% if the buyout turns out like it should if you buy at the $8.50 mark. If my math is right.

1-7-2022 I just won't buy stores now. Theft is to big nowadays. Amazon wins again. Look at the statements being made like 'Walgreens executives say the drugstore chain is losing about 50% more money due to loss and theft than it did prior to 2020' and I won't touch these stocks. This information makes me avoid the stock altogether.

1-7-2022 Right now I like oil, oil and oil and banks. That is it. Bank of America, Morgan Stanley, Signature Bank (SBNY) and Chevron, and maybe Devon Energy Corporation (DVN) and Pioneer Natural Resources Company (PXD) as they are in the Permian basin. Occidental Petroleum Corporation (OXY) is also a big oil producer in the Permian.

Sofi on my research won't do good so the pattern won't hold. It is more of a double top and Cramer was wrong. Cramer pounded the desk saying Salesforce, Wynn, and Matterport and Paysafe. If you listened to him you lost a lot of money. Cramer goes in the trash heap. These stocks are very good but not at this time and he shouldn't have been pushing them.

1-5-2022 How many experts said they love Shopify and its down 250 points this week. It is so clear only the big companies with earnings have a chance in this market.

1-5-2022 For those that like risky stocks, https://www.crownek.com/ Crown ElectroKinetics Corp. (CRKN) looks interesting. They help make glass green friendly and it is a new technology so very risky. But getting in now could make you alot but invest a small amount is my advice.

https://finance.yahoo.com/news/crown-electrokinetics-signs-first-commercial-113000621.html

1-4-2022 - I tried watching Jim Cramer and more same clap trap. I am in Caterpiller and Ford and they did good. Cramer seems to like all stocks so he can always say he is right. The tech stocks will get hammered when the FED tightens. My safe stock list above should do good this year.

12-30-2021 A lot of small players still talking Roku and now Lucid. Why didn't they buy Tesla in the 800's and skip Lucid. Roku I have no idea on but these people really like it. With more people back on home they probably think Roku will reignite.

12-30-2021 Razer had a good chance to be a real company and the founders are trying to take it private and screw over the shareholders. They will never be a Logitech type company. Shame since they had a chance and blew it because of greed.

12-30-2021 Now you have crooks putting out fake news. This time was Samgsun to buyout Biogen and the stock soars 20%. I've learned to stay the steady course. Now Samsung says the story is a lie and Biogen stock falls 20%. Shame on the news for even reporting this and again I no longer waste much time on Cnbc as they have lost my trust.

12-30-2021 The need to take wise risks is here. I notice Novavas at $153 is trading at the bottom of its range and is about to seek FDA approval for its vaccine which is the best vaccine and all natural and they can make billions of doses. Its a buy at this bottom range here.

And Sofi trades in a range from 14 to 24 and is at the low end of this range. 3 times Sofi has gone from 14 to 24 and back to 14. It truly is well run and a great company that could get a buyout offer at this low price.

These are stocks I am using risk money on. The rest of my money is in safe stocks.

12-30-2021 As I watch this horrible economy roll into 2022 I do see crypto making huge advances. But the economy will hold down crypto as well from just observing patterns. I didn't think the market get get half this bad.

12-30-2021 The economy is grinding to a stall. Money is going to companies who can pass inflation costs on and have earnings. Cnbc, Cramer, all got it wrong and and now deny and just move on. One lady on Cnbc who was calling these analysts out and she was awesome and probably got fired for doing it.

Why don't they just say inflation and the FED will start pulling money out of the market and 2022 will be a horrible year. Yes TSM should be having a great year and and a bright future but big money is rotating into safer stocks with big earnings. And TSM is a great company so imagine what is in store for the smaller companies this next year.

More and more analysts and industry experts are saying go into cash. That to me is unbelievable. You can thank the combination of Trump and Biden for it being this bad. Neither were prepared and Congress has no idea what to do. I don't think 2022 will be good.

12-28-2021 Sorrento analyst sees good chances for Sorrento covid test called Covistix. This detects the Omicron variant and while Sorrento has been accused of lying and driven this stock to $5 this would be a huge deal if they get FDA approval.

Article is here

12-28-2021 Small market pros are betting heavy on Docusign and Roku. I don't know what they see that I don't. Both good stocks but they should stay flat for a while as rotation is going into value. Maybe just because they have sold off so much.

12-28-2021 Upstart Holdings, Inc. (UPST) $148 has rolled over. Should see institutions buying this stock again. It might go softer to $140 which will probably spur even more buying. This is a good risky stock at this price for younger investors.

12-28-2021 Novavax, Inc. (NVAX) is in the buy range. Traders love this stock as they buy here and sell into the 170's. Now Novavax is going to submit to the FDA and this could cause a huge buy. Risky stock but younger investors could make a killing here.

12-28-2021 - Caterpillar is doing great and so is AMD. But AMD has Intel hot on it heels. This has happened before. AMD has a great cpu but a supply shortage out of its control kills it. AMD won't be able to make as many cpu's as it would like. It always comes back to hurt them in the end. AMD is smoking hot right now but it can't get away from the supply crunch where Intel who makes their own cpu's can and does make all they need and they sell them all. Intel has the talent to catch up so AMD is in trouble in the long haul with this high valuation. AMD can't make alot of cpu's and will be forced to lower prices.

So who is the winner. Apple. Apple seems to win even when they aren't in the picture.

12-23-2021 My current stocks I am buying. Caterpillar Inc. (CAT), Eli Lilly and Company (LLY) and Chevron Corporation (CVX) as oil remains high and will sell if oil goes to low 60's.

Every time Apple dips, sells off, I buy more Apple. In the 160's was a great buying chance.

12-23-2021 TuSimple Holdings Inc. (TSP) never go noticed until this week when Cathie Woods bought it. When Rivian and Lucid are making more EV's , electric vehicles, than GM and Ford it is time to sell Ford. Volkswagon is better than Ford for EV as they can make more. Tesla proves why it is #1. I'd rather own the chip makers like On Semi and NXP Semiconductors N.V. (NXPI) and lithium miners like Piedmont Lithium Inc. (PLL) and LAC. But take a look at TSP even though it moved this week.

12-23-2021 Buying the best for this market. Eli Lilly has blockbuster drugs coming and will do fine. With higher oil Caterpillar Inc. (CAT) is the winner like Chevron.

The rest of the stocks I hesitate to buy are AMAT, LRCX, ON, NXPI, TJX, WSM, RH are best of breed but facing a supply chain and inflation. I don't know why people are pushing these over dividend stocks in this bad and slow moving stock market. They brought the strongest economy in 50 years to a grinding halt and they are all blaming each other and Covid.

12-21-2021 The big sell off hasn't stopped. Even Warren Buffet says he can't make sense of this market. Watching the market and if it stays bad people will sit in safe dividend stocks.

12-15-2021 The big sell off has stopped or it is over. People came out to day buying chip makers and of course Apple and other big stocks. People will flock back to Nvidia and Broadcom but others have a good buying opportunity for their favorite stocks, Adobe or Cloudflare. I would say most people will go Microsoft and Google myself. Buy stocks with solid earnings like Proctor and Gamble. Avoid stocks that can't pass on costs. Sometimes you don't know if they can pass on costs. Maybe the car chip makers already have contracts and can't pass on costs.

12-15-2021 Worst CEO of the year has to be Zillow's CEO Rich Barton. Bar non he should be fired

12-14-2021 Apple losing its strength shows how weak the market is. There are so many reasons from profit taking due to tax changes to inflation and interest rate hikes. Everyone is in cash sitting on sidelines waiting for capitulation, the bottom of the selling to get back in. Timing that is just as hard as timing when to sell. I even saw Jim Cramer throw in the towel and say I don't know what to buy. So no buyers means the market slowly sinks until buyers come back. They will come back fast to. Probably the best tech and electric car stocks like Roblox , Tesla, Nvidia, Google, and I still like Ford with F150 lightning being backordered forever.

12-8-2021 Lithium Americas Corp. (LAC) is doign good and Piedmont Lithium Inc. (PLL) are great white gold, aka Lithium mining stocks. Barrons rates Piedmont the best but I buy both to diversify. I don't buy the car stocks unless they fall to under valued like Fisker did a couple days ago. But Rivian and Lucid are to high priced. I will stick with Lithium as it is white gold to me. These companies have protesters trying to stop them from polluting the water and they counter saying they are safe and won't pollute. So there is risk but I find it acceptable risk for all that lithium that is going up in price. Then there is Standard Lithium Ltd. (SLI) who has a process to mine lithium much safer. It is just unproven still and therefore I am watching it like a hawk to see if it works out because Standard Lithium Ltd. will license that technology to everyone if it works. Failure would drive SLI stock to pennies. So I am long just LAC and PLL

I got Ford stock at $19 that I will hold because if they are smart they will make electric F150's at 90% of their plants. Orders show a backlog for years. Ford will sell every F150 lightning as they call them and they also own 12%?? or so of Rivian so yes Ford is looking good to me. Because I would love an electric F150 but to long of a back order.

12-8-2021 SentinelOne missed the experts predictions so it will be in stock jail for a while. Inflation and Covid is going to keep driving stocks down and and like a wavy ocean. Not even inflation stocks are escaping Covid fears. Even stay at home stocks won't go up. So the back to work stocks are going down to. People are just pulling money from the market. Biden stimulus checks did nothing and they have to be paid for just like Trump's debt. You have all this stuff that needs to be paid for on the national debt now and Bidens new bills coming that will further kill the market. This was a very strong market that has been killed off. I see nothing I want to buy today. Nothing. Three of four months at least where inflation will hold everything down.

12-7-2021 SentinelOne, Inc. (S) $49.75 REPORTS after close today so decide fast! Huge drop created buying opportunity here. As with other tech stocks this week. Barrons did not change its price target of $75 so my research shows its dealings with Cloudflare and Z Scaler are great partners. They report today so you must get in by 4 pm today or you miss out on earnings.

12-1-2021 Tweaked my software with inflation variables set to high and I get two good stocks Jim Cramer picked a week ago. I agree these are good stocks for todays Covid inflation and supply chain problems.

UnitedHealth Group Incorporated (UNH) $452 and American Electric Power Company, Inc. (AEP) $81.

People will run into strong stocks like Microsoft and Google and Amazon so these are the stocks I also am buying.

Pros I watch are looking at PUBMATIC (Pubm) , Palo Alto Networks $542, Honeywell International Inc. (HON) $204, Okta, Inc. (OKTA) $210, PayPal Holdings, Inc. (PYPL) $187, Universal Display Corporation (OLED) $146.

My personal picks are risky. Standard Lithium Ltd. (SLI) $10.74 and Razer Inc. (RAZFF) .35 which is rumored to have a new handheld gaming console for XBox games. And Jim Cramer for loves Ford because of the F150 lightning electric pickup and they will sell like wildfire and the Rivian stock they own will cover their pensions so I give Jim a thumbs up on Ford.

11-30-2021 Inflation is here. My take is my software can't work in inflation..Impossible to pick stocks here. People will sell off stocks now to get write offs for taxes and avoid inflation. Major selling will happen when all the pros are picking strong end of year. On Cnbc they yelling at each other, something I have never seen. Even the host was getting angry with them. Inflation is now here! There is no one I know that can pick stocks in this environment. Coca cola would be the first one that comes to mind for anti inflation.

11-24-2021 Barrons picks for the Metaverse, they choose a weird one, Universal Media Group Inc. (UMGP) $1.85 and yes Barrons chooses a penny stock that they think has a chance to do great in the Metaverse.

They also chose a high fashion stock Kering SA (KER.PA) $710 that goes into the Metaverse to sell Gucci bags as NFT's you can redeem for the real thing. Very interesting. Also Farfetch might be doing that and the other high fashion companies.

11-24-2021 American Eagle has the best management in fashion. The TJX Companies, Inc. (TJX) $71 and Ross Stores, Inc. (ROST) $114 and those dollar stores might do good here as inflation hits.

11-24-2021 Inflation is here. Stocks sold off and rotated to the inflation safe stocks. Banks are the first that come to mind. Coca Cola and Chevron come to mind. Simon Property and Prudential also. Companies that can pass on the higher costs are good. That is why real estate is good here.

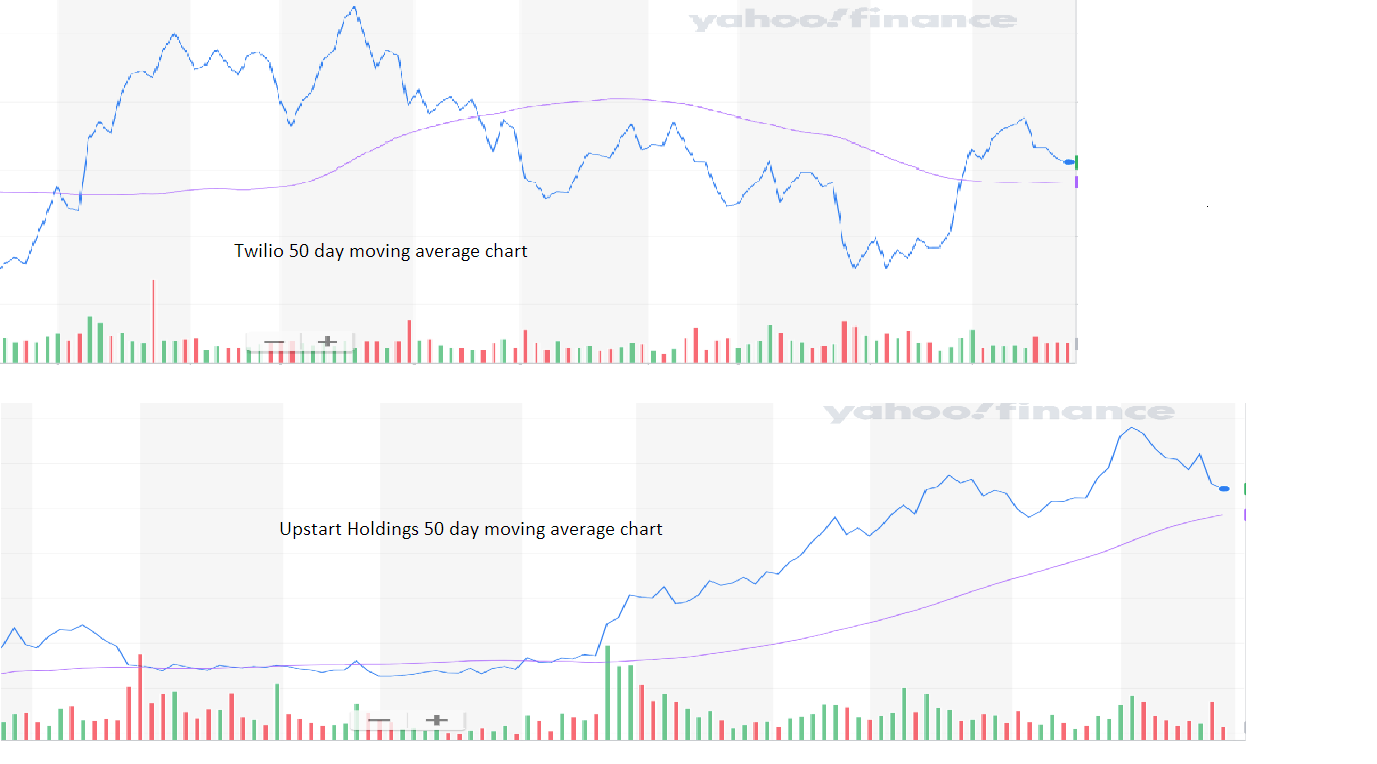

11-21-2021 stocks showing how high priced they are by the disparity between moving average and the stock price. Any inflation scare can send these stocks into a selloff even for Nvidia whose 50 day moving average is pictured here.

11-19-2021 Watching Cramer I agree that every covid scare selloff turns out to be a good time to buy. But buy the best. A big uh oh as Cramer said to sell Snowflake. I made good money off Cramer and I find his sell calls are 90% accurate but his buy calls 50%. So because I respect his sell calling so much I am ditching my Snowflake.

11-19-2021 Gotta sell some Nvidia $229 because once everyone owns it there is nobody left to buy it. I need to have a balanced portfolio and Nvidia has more than doubled in price.

11-19-2021 Micron Technology, Inc. (MU) is a great tech stock getting upgrades today. Game changer if they get into the metaverse with their new memory chips. Good to research this stock.

Rivian is still overheating and this pattern shows up alot. In two days I predict Rivian will selloff if it follows the other superhot stocks when they finally cool off.

11-18-2021 Expedia Group, Inc. (EXPE) is rated buy now after selloff. Good fundamentals.

11-18-2021 Apple and Amazon are strongest right now according to all indicators. iSun, Inc. (ISUN) $8 someone bought millions of shares of this today.

11-18-2021 My AI software says buy Apple. One it just pulled into the database is iSun, Inc. (ISUN) $8 which actually might be a good infrastructure play even though its a small cap. It might do good under Biden.

Lastly it lowered Rivian Automotive, Inc. (RIVN) to a sell. The double top head and shoulders that could form truly is scary if you own this stock. I don't own it but I would sell it here.

11-11-2021 The huge selloff gives a chance to buy Upstart Holdings, Inc. (UPST) $237.

Razer Inc. (RAZFF) .36 is up 12% again as talk about a takeover continues. A great company with great products and the buyout could be and should be around .50 cents. Sell now or see if it goes higher is a tough choice being up 25% already.

11-11-2021 My AI tool pick is PayPal Holdings, Inc. (PYPL) $211. I agree after the selloff.

11-11-2021 Doximity, Inc. (DOCS) $73 good buy point with insiders selling.

11-11-2021 I would try to buy these at close of the market around 3:58 or 3:59 if you can as day traders will probably dump their lot before close. Airbnb, Inc. (ABNB) $207 and SentinelOne, Inc. (S) $77. Airbnb is a nice long term stock but imo SentinelOne might fall after this breakout it is on ends and it has earnings release soon. These are not value stocks , but risk growth stocks the AI picked.

11-11-2021 Serious buyer, but will they sell?

11-11-2021 Doximity Lock-up Expiry on November 12, 2021 . That means alot of insiders can sell tomorrow. Will they? They will probably sell right at opening which means the stock should drop and give us a good dip to buy on. Doximity is where the big pharmas buy ads because of all the doctors on the site.

11-11-2021 I am now using AI, Artificial intelligence , to give me tips on stocks that are headed up. Years of work have gone into this and now its time to use it. My testing has shown its predicting stocks 30% better than I am. You probably don't have the programming experience to do the AI yourself or pay someone for a year and spend $100,000. So hopefully mine saves you the time and money and helps you find stocks. I have an AI programmer friend who helps me put the core into it so I saved money to and will use it and share the data with you guys here.

11-11-2021 A stock on the dip is Biohaven Pharmaceutical Holding Company Ltd. (BHVN) $123 and could make you 5% or more. Looks like the sell off is over and if it goes up 10% you can sell or hold if you think its Nurtec drug will be a blockbuster.

11-11-2021 Upstart Holdings, Inc. (UPST) should keep selling off as margin calls hit it hard. It had poor guidance and dropped big time where margin calls will come into play here. So around Nov. 16 the stock will be safe to buy. The institutions might come in before that but that is the game. Buying now is fine after the huge drop but I would like to make sure the margin calls are out of the way before I buy as it could drop alot more if there were a lot of people using margin to buy this stock. They will be forced to sell in 3 to 4 days and I am guessing here but I plan to play it safe.

On Nov 16 I will buy as this stock will have a good future.

11-9-2021 Hertz seems like a great buy because insiders are selling during this IPO. You have insiders selling and Hertz itself is buying stock back. So a huge plus and huge con. Never seen this before. Once the insiders are done selling this stock should go up. If you think rental cars will double again. It is like a free gift of 10% off discount to me.

11-9-2021 Had to help my mom yesterday and I missed Roblox, uhg.

Today Wynn Resorts, Limited (WYNN) $93 and Upstart Holdings, Inc. (UPST) $316 are reporting today. The experts I talk to love these 2 and tell me you can take a chance on these with your risk money. I asked them if they are and they said yes!

Risk money only!

11-8-2021 Upstart Holdings, Inc. (UPST) hit low $322 and people now buy it going into earnings tomorrow. I bet many sell right at 3.59 pm est because its a huge momentum stock and they know people will bet big on its earnings and they see this as easy money. They won't even hold to hear the earnings as they just want a quick 4% gain. It works because Upstart is super hot like Peloton once was. Now Peloton is at $50 , wow. Now it is Upstart Holdings time to shine and hopefully they have better management.

11-8-2021 Intel dumped its CEO. People were leaving the company they hated him so much. Now Intel seems to be employee friendly and the cpu engineers are coming back. Now Intel has released a new cpu that is actually good! Their Alder Lake cpu is very fast according to Toms Hardware website. They priced it below AMD's cpu so they will cut into AMD's profits. Intel just had capitulation where a huge number of shares are sold. So we are fairly safe in saying a bottom is hit. I've seen Intel do this before and they will hire the best engineers now and get to 7 nm cpus fast. They are also building more fabs and they are still a profit making machine. A great value stock with their new CEO.

11-8-2021 NVDA has its conference this week. Should be interesting and might help boost its stock.

Nucor could make good money off infrastructure bill at get back to $127.

11-8-2021 AMD is sky high so again you have to think of taking profits. Sell half of AMD to lock in profits and let the rest run. Tesla has also topped out imo. Hard to see Tesla going higher for a while with so much competition coming.

Infrastructure stocks won't make as much money as people think but they will make money. I see people already taking profits on Nucor and Cleveland Cliffs.

I suggest the ETF funds for water Invesco Water Resources ETF (PHO) and Invesco S&P Global Water ETF (CGW) are worth a look.

Nucor was at $127 so I think anything aroun $119 is a buy for Nucor.

11-8-2021 Rivian upped its IPO price to 74 from 57, 8% more. They might up it more. But the play for me is Ford who owns 10% of Rivian and Amazon who owns 20%. They just gained 8% ! So I bought them in after hours.

11-5-2021 I told you imo Hertz Global Holdings, Inc. (HTZZW) was the way to go. Up 8% today. Sell if you want to but I think it can hit 22. Another 8%? I think Hertz is back and they will get back on the Nasdaq and these warrants will be worrh even more. At $19 I had to say buy! Management is solid so far.

11-5-2021 Zillow Group, Inc. (Z) $66 , Micron Technology, Inc. (MU) and Teladoc Health, Inc. (TDOC) are worth looking into. I have to research more on them but Zillow has had a huge selloff and if they get new leadership that understands the internet they will rise back up. Lot of ifs with these stocks but worth looking into

11-5-2021 Carnival Corporation & plc (CCL) if you believe Covid will end. Then you want to go crazy risk then I see 2023, yes 2023 options for Carnival to hit $40 priced at just $1.55 and I can see Carnival taking off with the end of covid. It is to late to try Expedia or Airbnb

I just saw 2023 Carnival Corporation & plc (CCL) with a strike price of just $30 for $3 and I am thinking with end of covid these are a great risk bet. I can see Carnival filling its ships up and hitting $60. I only take bets in options I feel real good about and if they fail then that is ok with me. This was to good to pass up seeing travel stock options all going up fast.

11-5-2021 U.S. Global Jets ETF (JETS) is a great play with interconintental travel from country to country back on! This stock could still hit $30 a share.

Hasbro, Inc. (HAS) with its movie deals is a great re-opening play.

Casinos I am buying a few to diversify. But just starter positions. Golden Entertainment, Inc. (GDEN) $51, Boyd Gaming Corporation (BYD) $67, Vail Resorts, Inc. (MTN) $371 , Caesars Entertainment, Inc. (CZR) $107, Las Vegas Sands Corp. (LVS) , Wynn Resorts, Limited (WYNN) $97. With $0 commission trading I can do this.

11-5-2021 I was looking at expedia and AirBnB as the alternative to cruise lines for the reopening. Then saw they were both reporting yesterday. Now today Pfizer comes out with a covid pill. So the immediate rotation to re-opening stocks will probably occur.

Norwegian Cruise Line Holdings Ltd. (NCLH) $28.50 and aesars Entertainment, Inc. (CZR) $106.54 are the ones that come mind. Retailers like American Eagle and abercrombie and fitch are my favorite retailers. Beauty cosmetic stocks will do good now. People will start going out again.

The first Metaverse stock seems to be named, NVIDIA Corporation (NVDA) $310. It has created a system that Facebook will use in its Metaverse. But it is hard to buy at these steep levels. I can see people saying its the Tesla of the Metaverse and will hit 1 trillion. Maybe...I was already in big last month so for me its all profit.

11-5-2021 I still got my eyes on Doximity who sell high priced ads in thier software system to pharmas who spend alot to get doctors attention. Upstart Holdings who use AI to help banks become more efficient in loans and not rely on just the plain FICO score.

11-4-2021 No idea on how Apple will effect Roblox because they can't track people as good now.

Hertz Global Holdings, Inc. (HTZZW) is the best way to play Hertz. It is the warrants which is like an option but is actually stock. To me it is better than owning the normal stock. Hertz will list on the Nasdaq soon and that should life the price and they report earnings and seeing Avis did great I think Hertz will do fine.

11-4-2021 Jim Cramer put Zillows CEO Rich Barton on his Wall of Shame for many reasons. But basically called him stupid and wants him fired, ouch. Cramer basically lost it but he is right that Barton needs to be fired. In my opinion he is a liar and his ego is to big and I would fire him.

11-4-2021 Activision announced huge problems at their company right before they are to release Call of Duty and they are delaying other games. I am trying to figure out AppLovin and I also notice Roblox Corporation (RBLX) in the 70's. Sell Activision and buy Roblox but I will wait until tomorrow when Activision releases Call of Duty. I will pick up some Roblox for the Metaverse play. I already own Unity, symbol U

11-4-2021 Cathy Woods bought Twilio and Teledoc and she always causes other people to buy and run the stock up 5%. I wonder if these stocks will fall back after a few weeks. She really finds some unique stocks like PagerDuty, Inc. (PD) and UiPath Inc. (PATH) which I have no idea or comments on. They sound great but will they make money and are they run by good leaders. This is why everyone jumped on Snowflake, great leader. She bought facebook and Velo3D, Inc. (VLD) which is a 3d printing company that has Elon Must as a client. She still likes Zoom video even with every big company like Microsoft gunning for Zoom.

11-1-2021 Jim Cramers annointed list for the rest of the year. I guess this means he is saying these will go up for the next 2 months. ON Semiconductor Corporation (ON) , NXP Semiconductors N.V. (NXPI) , Tesla, Inc. (TSLA) , Ford Motor Company (F) , Chevron Corporation (CVX) , Devon Energy Corporation (DVN) , Meta Platforms, Inc. (FB) , Snowflake Inc. (SNOW) , Advanced Micro Devices, Inc. (AMD) Microsoft Corporation (MSFT) , NVIDIA Corporation (NVDA) , Enphase Energy, Inc. (ENPH) , Plug Power Inc. (PLUG)

Everything is hot right now. Cars and Hi tech chip stocks but many people want to bail right now before the supply shortage ends. I don't know what to tell these people. I will get out when the time says to get out.

Many people see a stock go up 10% and want 20% and if the stock goes up 20% they want 30%. I've watched institutions and traders sell at 10% and just take profits since they invest so much money. There are just a few Tesla's out there the rest of the stocks will come back down. They follow the 50 day moving average for the most part. You have to have a balanced train of thought and look at all the numbers and take your research into account. Everyone I know like Razer mice but what about the other stuff Razer makes. I have no idea if they sell just as good as their mice. But I notice it is not listed on the Nasdaq but an OTC stock so if I compare it to Logitech I see Razer is a nice value worth betting on.

If you take your profits at the right time and don't get greedy you will do fine. I sold half my upstart holdings at 160 and now its 355 but I still make money. Novavax I bought at 280 and it fell to 130 and I bought more. Now it is back to 200 and those that swore and sold are now swearing again for selling. I have made more off the dips in Novavax to cover my losses but I am still holding those losses and if Novavax hits 280 I will break even on my losses with huge profit on the shares I bought at $130.

What is next. Well I noticed Chegg, Inc. (CHGG) at $32 and it was just at $110. So is this a bad stock or just oversold. I do not know this industry.

I notice Avis up big. Avis Budget Group, Inc. (CAR) at $360 but this was due to Hertz going bankrupt. I don't thik Avis can repeat this and yes I didn't even think about this and missed an easy triple here. In fact I could see people buying some options plus the stock since Hertz was in trouble but, yes but that is over now. Hertz is back and should even out the playing field in the auto rental sector. Now they will duke it out and when the supply chain shortage ends so will their profits. Now remember that and read the news and sell when the time says to sell.

I sure was wrong about Twilio. But I still believe this company has a great future helping tech companies move into the future. As anyone who bought at the low on this huge dip is gladly smiling proving this company is far from done.

Novavax has moved up from 135 to 155 and soon I believe 200. So this should offset Twilio but I expect Twilio to rebound and I end up big.

11-1-2021 I've watched American Eagle AEO go from 25 to 33 so many times. Will it do it again. I think it might. Options traders have made a killing in this stock doing this trade over and over again. I can't believe it is back at 25. I will buy options this time even though it is high risk. I can't believe I can get 2024 calls at the target price of 40 for $2.50. This is a pure bet based on my research and quality of American Eagle. The stock is better for investors here but for crazy option traders this is a great bet for 2024 at this price.

11-1-2021 Yes I sold half my Razor stock since it popped 12%. In this market everything seems to go up and down so I took half the stock as profit and will let the other half run.

11-1-2021 People that want to play 3d stocks and don't have time to do the research can buy The 3D Printing ETF (PRNT) $38.41 . I think this is a good fund. It owns the top 3D companies so the risk is spread out.

11-1-2021 Microvast Holdings, Inc. (MVST) $9 and Standard Lithium Ltd. (SLI) $12 are hot new lithium stocks that are small and their technology proves out will make them soar.